Refine results

Latest Employment and Market Insights – February 2025

Stay informed and navigate Australia’s evolving employment landscape with our latest recruitment and labour market insights.

Unemployment rate rises to 4.1% as participation grows

The seasonally adjusted unemployment rate rose by 0.1 percentage point to 4.1% in January, according to recent data released by the Australian Bureau of Statistics (ABS). This change reflects a rise in both employment (+44,000) and unemployment (+23,000), pushing the participation rate to a record high of 67.3%.

Key Insights:

Employment grew by 0.3% in January, maintaining the average monthly growth rate seen in 2024 and outpacing population growth (0.2%).

Female employment saw the most significant increase (+44,000), with a corresponding rise in female unemployment (+24,000). As a result, the female employment-to-population ratio reached a record 60.8%.

The overall employment-to-population ratio also hit a new high of 64.6%, up 0.8 percentage points from a year ago.

The unemployment rate for women rose to 4.1%, aligning with the rate for men.

Hours Worked:

Seasonally adjusted monthly hours worked fell by 0.4%, reflecting the usual January trend of reduced working hours. However, this decline was smaller than in previous years, signalling a return to pre-pandemic patterns.

For businesses, these figures indicate a resilient labour market with strong participation rates. Employers should remain proactive in talent attraction and retention strategies, particularly in sectors with higher female workforce representation.

| Key statistics – Trend | Dec-24 | Jan-25 | Monthly change | Monthly change (%) | Yearly change | Yearly change (%) |

| Employed people | 14,582,700 | 14,616,400 | 33,700 | 0.2% | 424,100 | 3.0% |

| Unemployed people | 614,600 | 615,100 | 500 | 0.1% | 37,300 | 6.5% |

| Unemployment rate | 4.0% | 4.0% | 0.0 pts | N/A | 0.1 pts | N/A |

| Underemployment rate | 6.0% | 6.0% | 0.0 pts | N/A | -0.6 pts | N/A |

| Participation rate | 67.2% | 67.2% | 0.0 pts | N/A | 0.5 pts | N/A |

| Monthly hours worked in all jobs | 1,974 million | 1,976 million | 2 million | 0.1% | 53 million | 2.8% |

| Source: Australian Bureau of Statistics, Labour Force, Australia January 2025 | ||||||

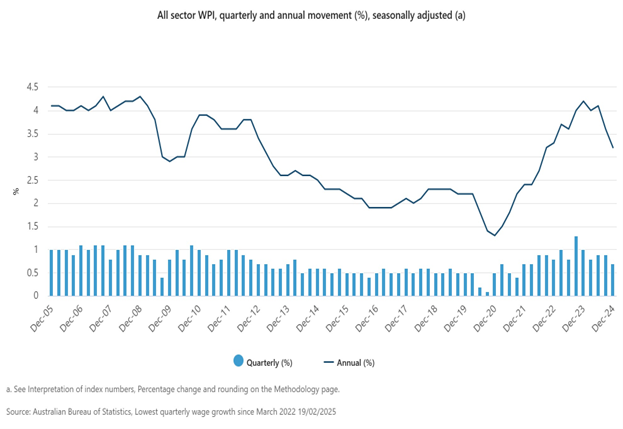

Lowest quarterly wage growth since March 2022

Source: www.abs.gov.au/media-centre/media-releases/lowest-quarterly-wage-growth-march-2022

The Wage Price Index (WPI) rose 0.7% in the December quarter 2024, and 3.2% over 2024, according to seasonally adjusted data released by the Australian Bureau of Statistics (ABS).

Quarterly wage growth in the private sector was 0.7%, lower than 0.9 percent in the December quarter 2023, and the equal lowest rise since the March quarter 2022.

Compared to the December quarter 2023, the private sector saw a drop in both the proportion of jobs with a wage movement (+14% compared to +16%), and the average hourly wage change (+3.7% compared to +4.4%).

“This was the smallest proportion of jobs with a change in wages for the private sector in a December quarter since 2019,” Ms Marquardt said.

AHRI’s latest Work Outlook report

AHRI’s Quarterly Australian Work Outlook – a quarterly report monitoring the state of the Australian labour market, offers a forward view of the work environment facing HR professionals and business leaders.

The AHRI Net Employment Intentions Index, which measures the difference between the proportion of employers that expect to increase staff levels and those that expect to decrease staff levels decreased to +39 in the March quarter of 2025.

While this is in line with the historical average for the survey, it represents a cooling from +44 in the December 2024 quarter.

The decrease has been driven by a relatively strong fall in employment-intention expectations in the public sector, which have fallen from +57 to +40 during the same period.

A snapshot of the report:

- 42% of organisations intend to increase staff levels in the March 2025 quarter, compared with just 3% that anticipate reducing the size of their workforce over the same period

- 64% of organisations plan to recruit staff in the March quarter of 2025, slightly down on the figure recorded for the December 2024 quarter (67%).

- 23% of employers intend to make some staff redundant this quarter – slightly lower than in the December 2024 quarter.

- 30% of organisations are experiencing recruitment difficulties in the March 2025 quarter. This equals the lowest level for recruitment difficulties recorded in any of our surveys

- The survey data shows that the most frequent reason for employees leaving organisations is excessive workload, which is cited by a quarter (26%) of employers. This is followed by unattractiveness of the role (21%), conflict or poor workplace relationships (21%) and too few learning and development opportunities (19%)

- The measures used most frequently by employers to help retain staff are increased learning and development opportunities (36%), enhanced flexible working arrangements (36%), and improved support for employee wellbeing (36%).

- Employers reported that the mean basic pay increase in their organisation (excluding bonuses) is expected to be 3% for the 12 months to January 2026, up from 2.7% for the 12 months to October 2025

WGEA Report

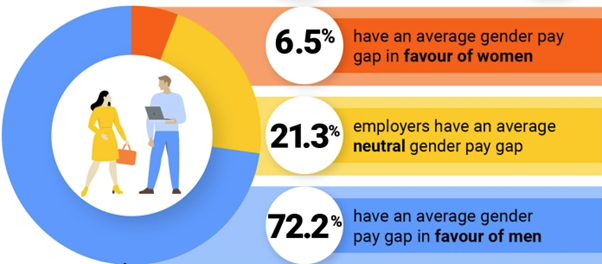

In the recently released WGEA Employer gender pay gaps report, data from employers with 100 or more employees showed that on average, women earned $28,425 less than their male colleagues.

The report confirmed that 72.2% of employers had a pay gap favouring men, 21.3% are considered ‘neutral’ – where the gap that exists is within a +/- 5% range.

6.5% of employers have a pay gap that favours women.

According to WGEA “In every industry, men are more likely to be employed in the highest earning roles compared to their proportion in the workforce.

In contrast, women are over-represented in the lowest earning quartile compared to their representation in the industry in 17 out of 19 industries.

High-paying industries show the greatest disparity between men’s and women’s access to the highest paying roles.

This is the case even when the industry is gender-balanced.”

Related Articles

Leading with Heart and Vision: A Conversation with Dixon Appointments’ New General Manager, Jules Seletto

After more than 25 years of shaping careers and connecting exceptional talent with opportunity, Dixon Appointments…

The Best New People: vocational internship

As part of a long and trusted partnership with Deakin University, Dixon offers vocational internships to psychology students once or…