Refine results

Latest Employment and Market Insights

Employment market trends

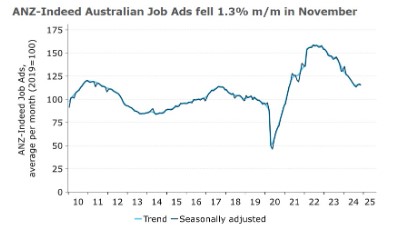

Despite this decline, the overall trend shows job ads are 0.4% higher month-on-month in trend terms and remain 15.1% above pre-pandemic levels, although down 27.6% from their peak in June 2022.

Analysts suggest seasonal hiring may have influenced recent trends, with earlier recruitment activity potentially driving the September and October increases. Whether this recent dip signals a broader downturn will become clearer in the coming months.

Australia’s unemployment rate remains low, averaging 4.0% over the past year, aligning with estimates of “full employment”—the lowest sustainable level of unemployment consistent with stable inflation. However, signs of easing wage growth suggest the labour market may currently be operating slightly above full employment capacity.

At the state level, most regions experienced declines in job ads during November, with Tasmania, Western Australia, and Victoria seeing the largest decreases. However, Queensland was an exception, with job ads climbing for the third consecutive month, reaching their highest level since February 2023.

Sector-specific trends reveal Christmas-related hiring continues to impact the job market. While retail opportunities dropped sharply in November, this was partly balanced by increased demand in food services ahead of the holiday season. Other sectors such as education and personal care also saw notable growth during the month.

This snapshot highlights both the resilience and the evolving dynamics of Australia’s employment market as it adjusts to seasonal shifts and broader economic conditions.

Demand for part-time employees continues

Other recruitment industry experts like Ross Clennett note that though unemployment is low, the growth in employment has been dominated by part time employment, reflecting a preference for flexible workforces, where employee hours may be scaled up or down to avoid unnecessary fluctuations in headcount.

“In the July 2023 – June 2024 financial year, total employment grew by 2.8%, but full-time employment only grew by 0.7%; meaning 3 out of every 4 new jobs created was part-time. Total monthly hours worked in all jobs grew by only 0.5% across the same period, meaning that part-timers, on average, were working fewer hours each week compared to a year earlier”.

Long-Term Unemployment Rises as Entry-Level Jobs Decline

A recent report from the Australian Council of Social Service (ACOSS) highlights a concerning trend in Australia’s labour market, noting a decline in entry-level job opportunities alongside a significant increase in long-term unemployment. The findings call for a comprehensive review of Australia’s employment services to better support job seekers facing systemic barriers.

The report, Faces of Unemployment 2024, reveals that since mid-2022, employment in low-skill roles has grown by only 1.9%, compared to 7.8% overall.

Meanwhile, job vacancies for entry-level positions have dropped by 39%, outpacing the overall decline of 30%. This has led to a steep rise in competition for available roles, with 4.9 job seekers per vacancy compared to 2.9 two years ago.

Additionally, the report notes that entry-level jobs now comprise only 38% of total employment, a drop of over four percentage points since 1998. This reduction has disproportionately affected people reliant on income support, many of whom face significant challenges transitioning into the workforce.

Long-Term Dependency on Income Support Increases

The data shows a growing number of Australians relying on income support for extended periods. Currently, 557,000 people have been receiving unemployment payments for over a year, with 190,000 of these individuals on support for more than five years. Among those unemployed long-term, half report health conditions, the majority are women, and nearly one-third are aged 55 or older.

Workforce Australia, the country’s primary employment services program, is struggling to assist job seekers effectively. Only 11% of participants have secured sustained employment lasting six months or more.

Australia Introduces Core Skills Occupation List to Address Workforce Shortages

In a move aimed at tackling critical workforce shortages, the Australian government has unveiled the new Core Skills Occupation List (CSOL). This comprehensive list features over 450 occupations across various industries, including construction, agriculture, cyber security, healthcare, and education.

The CSOL will play a pivotal role in the Core Skills stream of the upcoming Skills in Demand visa, which is set to replace the Temporary Skill Shortage (subclass 482) visa on December 7. It will also be integral to the Direct Entry stream of the permanent Employer Nomination Scheme (subclass 186) visa.

The government emphasises that the list is part of a broader strategy to address critical gaps in the workforce. One priority area is construction, where shortages have significantly impacted housing supply. “This initiative aims to attract qualified workers to help meet the growing demand for housing,” noted government representatives.

Industry Support for Targeted Migration Initiatives

The Business Council of Australia (BCA) has welcomed the CSOL as a significant step in addressing workforce challenges. The organisation has long advocated for a skilled migration system that aligns with Australia’s economic needs.

“Today’s announcement is a positive move towards filling urgent gaps in the workforce, particularly in sectors like construction, where skilled workers are essential to boosting housing supply,” stated the BCA.

The council also highlighted the importance of balancing migration with domestic workforce development. “While we work to ensure Australians are equipped with the skills to thrive in emerging sectors, immediate shortages necessitate targeted migration policies to fill critical roles,” BCA representatives added.

The new CSOL underscores the government’s commitment to creating a robust, responsive skilled migration system that complements efforts to train and upskill local talent. It reflects a dual focus: addressing immediate workforce needs while building a long-term pipeline of skilled workers to support economic growth.

Cyber Crime leads to rising costs for small businesses

The Australian Signals Directorate’s (ASD) latest Cyber Threat Report reveals a persistent cyber-crime threat, with a report filed every six minutes. While larger businesses have improved defences, small businesses face growing costs due to limited resources and awareness.

ASD emphasises that cyber security is an ongoing effort:

Key Findings for 2023-24:

- Hotline Activity: Over 36,700 calls to the Australian Cyber Security Hotline—a 12% increase from last year.

- Cyber Crime Reports: 87,400 reports, consistent with last year’s pace, despite a 7% overall reduction.

- Ransomware: Now present in 11% of incidents, up by 3%.

- Cost Impact: Small businesses saw an 8% rise in cyber-crime costs, averaging $49,600 per report. Medium and large businesses experienced cost reductions, with medium businesses seeing a 35% drop.

Common Threats:

- For individuals: Identity fraud (26%), online shopping fraud (15%), and online banking fraud (12%).

- For businesses: Email compromise (20%) and fraud via online banking (13%) or business email compromise (13%).

Prepare:

- Develop and test an incident response plan.

- Secure Systems: Adopt secure-by-design principles and the ASD Essential Eight framework.

- Enhance Authentication: Enable multi-factor authentication (MFA) and use strong, unique passphrases.

- Stay Updated: Regularly back up data and apply software updates promptly.

- Educate Staff: Train teams to recognise phishing and scams.

Leverage Resources:

Use free tools and advice through ASD’s Cyber Security Partnership Program.

With malicious actors evolving their methods, proactive collaboration between public and private sectors is critical to bolstering Australia’s defences against cyber threats.

Related Articles

Latest Employment and Market Insights – February 2025

Stay informed and navigate Australia’s evolving employment landscape with our latest recruitment and labour market insights. Unemployment rate rises to…

Dixon Appointments and Talentpath Recruitment Form Bold New Strategic Partnership

Dixon Appointments and Talentpath Recruitment Form Bold New Strategic Partnership Values-based partnership to accelerate growth for both female-led, Australian-owned…